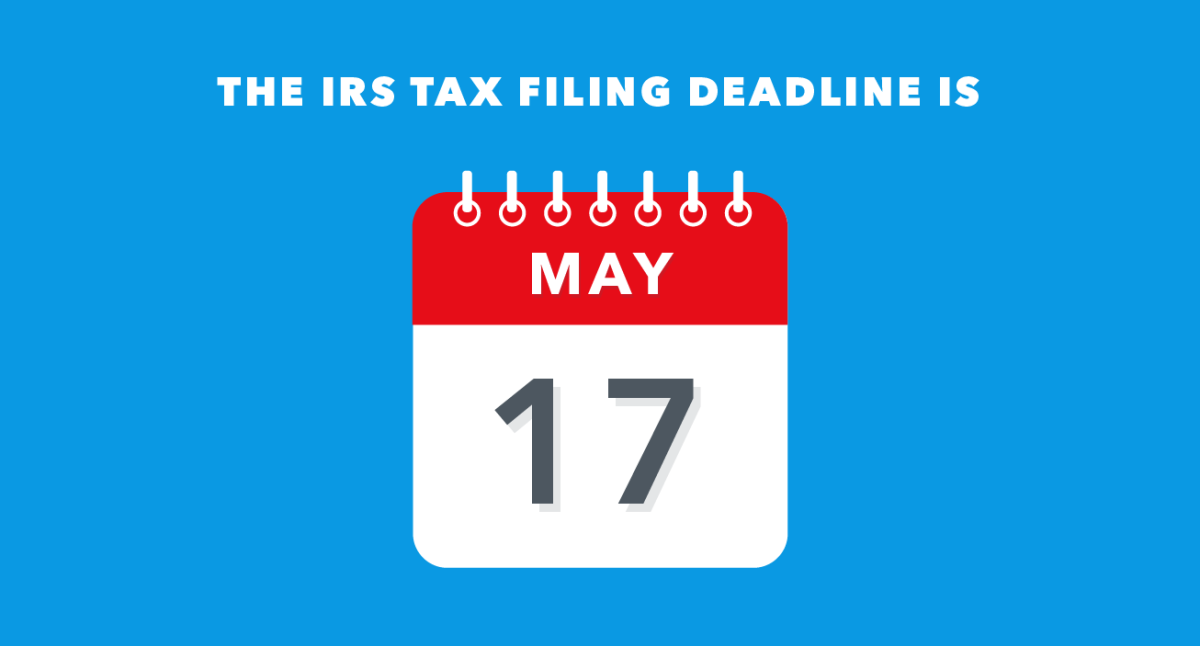

The IRS and Treasury Department have announced that the deadline for filing individual 2020 returns has been extended from April 15, 2021 to May 17, 2021.

“This continues to be a tough time for many people, and the IRS wants to continue to do everything possible to help taxpayers navigate the unusual circumstances related to the pandemic, while also working on important tax administration responsibilities,” said IRS Commissioner Chuck Rettig.

This will give taxpayers additional time to file their returns while considering any available tax relief and changes to the recent stimulus bill.

- This extension applies only to individual taxpayers, including those who pay self-employment tax.

- There are no penalties or interest on the amount of taxes owed, if the taxes are paid by May 17, 2021.

- Taxpayers who put their returns on extension will have until October 15, 2021, to file, regardless of this change to the original deadline.

- The first quarter of estimated taxes for 2021 are still due on April 15, 2021.

- This is an automatic extension and does not require notifying the IRS or filing any forms.

- This change of federal deadline does not extend your state income tax deadline. There are 42 states plus the District of Columbia.

You should consider filing your tax return as soon as possible, especially if you are entitled to a refund.