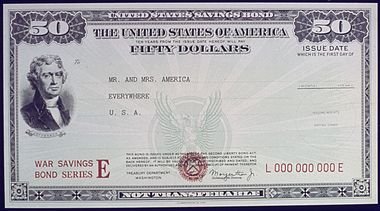

Here’s a scenario we have seen a number of times: A parent comes in for estate planning owning fully-matured Series E savings bonds with beneficiaries named on them. What are the alternatives are for paying the income tax and penalties? And who will have to pay the tax – the estate or the beneficiaries? As with many legal questions, the answer is “It depends.” Here are the options.

A national bank can help with the bonds. They can go to the Treasury department’s website and look up the values by the bond serial number. Series E bonds only pay interest for 40 years from their issue date. Once the bond reaches final maturity after 40 years, the interest on that bond to that point is taxable. But when and to whom the tax will be assessed is based on the following choices.

The owner can elect to declare the interest (that is, let the interest continue to stay in the bond). If the owner elects to declare the interest, all of the interest for prior years will be taxable to the owner in the year the owner makes the election. (This would prevent the interest from being taxed to the beneficiaries after the owner’s death.) Note that if the owner declared the interest, the election continues during the owner’s lifetime as to the interest during the owner’s lifetime, but the estate and beneficiaries can still defer the post-death interest.

The interest could be declared on the deceased owner’s final personal income tax return, since sometimes a decedent has very little income in the year of death (for example, if the decedent dies early in the year, or has high medical expenses).

Or, the interest could be declared on the estate’s income tax return, since the deceased owner’s estate might have administration expenses in excess of its other income.

Sometimes it may be best to distribute the bonds without declaring the interest, so the beneficiaries can continue to accrue the interest. The beneficiaries can declare the interest and elect to pay the taxes in a year when their other income is low or deductions are high.

Planning TIP: Most folk do not realize that they can claim this savings bond interest income without redeeming the bond. In years where they have little taxable income, or very large medical deductions and they do not have enough taxable income, they could report the taxable income on the bonds without redeeming the bonds rather than waiting until they die or redeem the bonds. This could reduce their or their estate’s income taxes.

Courtney Elder Law attorneys are happy to assist you and your family with all of your estate planning and asset protection needs. Please do not hesitate to contact us at 866-ELDERLAW if we can be of assistance.

Handling Mom’s Old Savings Bonds